A Property Tax Could Best Be Described as

It exempts 25000 of a homes assessed value from property taxes with an additional exemption of 25000 for your homes assessed value between 50000 and 75000 for non-school property taxes. Department of Veterans Affairs VA as of Jan.

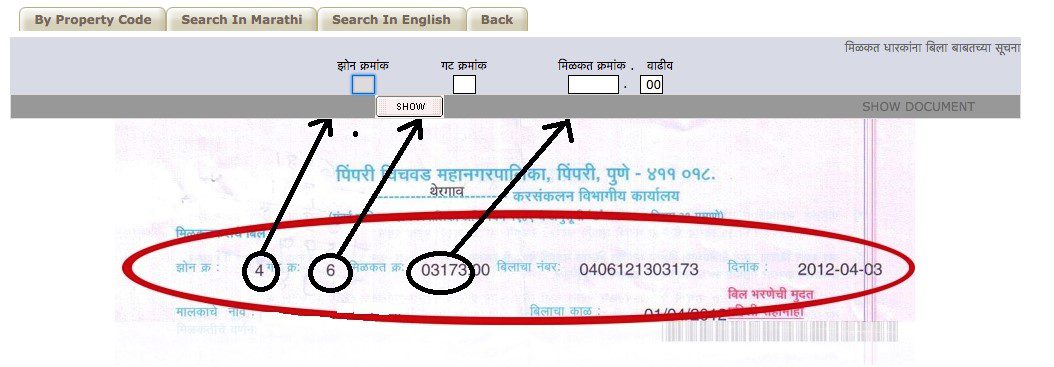

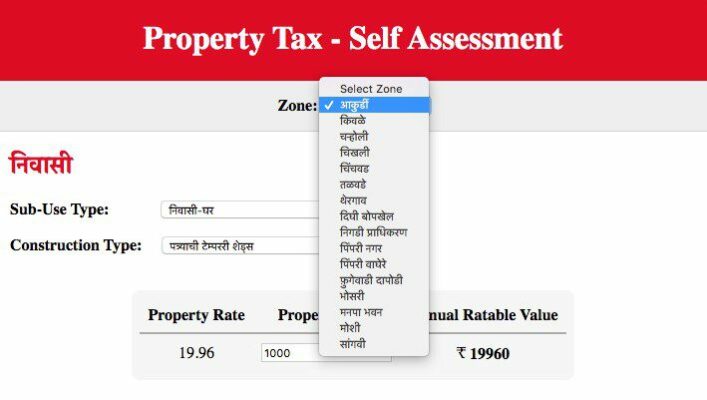

Pcmc Property Tax 2022 Guide Step By Step Online Payment Process

In some Florida counties.

/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)

. To improve lives through tax policies that lead to greater economic growth and opportunity. The Veterans Property tax benefit is described in Idaho State Tax Commissions publication 650. There are five basic classes of property in Minnesota.

Intuit will assign you a tax expert based on availability. Access to tax advice and Expert Review the ability to have a Tax Expert review andor sign your tax return is included with TurboTax Live or as an upgrade from another version and available through December 31 2022. Please be aware that the.

Highest and best use is the use that is financially feasible physically possible legally permissible and maximally productive. Additionally veterans who receive 100 compensation due to individual unemployability by the US. Depending on your local property tax rate the homestead exemption could mean hundreds of dollars in tax savings per year.

1 2022 can qualify for this benefit. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. These are provided in Minnesota Statutes section 27313.

Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. For over 80 years our goal has remained the same. In addition the separate property of each spouse brought into a community property.

CPA availability may be limited. The 2008 legislative session resulted in significant changes to some of the classes of property in Minnesota. Tax Advice Expert Review and TurboTax Live.

The Tax Foundation is the nations leading independent tax policy nonprofit. The assessors offices are working in the 2021 year currently. The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021.

This program is for veterans recognized as 100 service-connected disabled veterans. Community property laws however also are important for individuals residing in non-community-property states because property acquired in community property states and brought into non-community-property states ordinarily remains community property for state law and tax purposes.

Best Real Estate Tax Tips Estate Tax Real Estate Articles Real Estate

Example Rental Deposit Form Acceptance Letter Business Template Deposit

What Is A Homestead Exemption And How Does It Work Lendingtree

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Not Really Funny At All Income Tax Property Tax Capital Gains Tax

How Much Does Holding A Property Really Cost Check Out The 6 Holding Costs That Add Up The Most Hold On Selling Your House Spending Money

Not Really Funny At All Income Tax Property Tax Capital Gains Tax

Property Tax Defined And Explained Quicken Loans

Pcmc Property Tax 2022 Guide Step By Step Online Payment Process

/gettyimages-1299026418-1024x1024-53a7a37a410d4c749c0060f7bcc7f813.jpeg)

Personal Property Tax Definition

Pin By Martin Campbell On Governance Domestic Policy Grad Student San Diego Apartments Angela Davis

Best Tips For Lowering Your Property Tax Bill Property Tax Real Estate Articles Mortgage Savings

Deducting Property Taxes H R Block

Having The Facts About Values In Your Neighborhood Will Let You Know If Your Assessment Is Too High The Neighbourhood Property Tax Assessment

Comments

Post a Comment